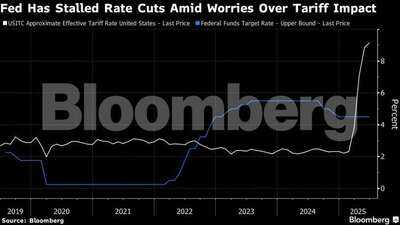

The impact of President Donald Trump’s tariffs on consumer prices is just getting started, according to research by Goldman Sachs Group Inc., adding more uncertainty to a Treasury market that has been gripped by shifting bets on the pace of interest rate cuts.

US companies have so far taken the bulk of the hit from Trump’s tariffs but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote in a note. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote.

The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December, according to the Goldman analysts. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

The report adds weight to a widespread view among economists that Trump’s sweeping tariffs will fuel inflation at a time when Fed policy has become a hot topic not just for bond traders but even for the president himself. Trump has broken convention by publicly calling for the Federal Reserve to cut rates, suggesting Fed Chair Jerome Powell should resign and adding an ally — at least temporarily — to the monetary policy committee.

Bond traders are now looking ahead to Tuesday’s inflation data for clues on how fast the Fed can cut. Treasury 10-year yields rose around seven basis points last week, but fell during European trading hours Monday.

Traders are pricing in a more than 80% chance of a rate cut at the Fed’s next meeting in September, but the prospect of more easing in the months to come is clouded by the uncertain impact of tariffs on inflation.

Staggered Impact

Most economists consider tariffs to be inflationary, since logic suggests companies will pass the additional costs onto their customers. But the view isn’t unanimous — and the debate partly comes down to definitions.

“Inflation, certainly as it’s relevant to a central bank setting monetary policy, concerns an ongoing increase in the overall price level,” said Oren Cass, founder and chief economist at American Compass, in a recent episode of Bloomberg’s Trumponomics podcast. “If you choose a specific policy that by design makes a one-time change in the price of certain things, that is not inflation in a sense that you would want a central bank to worry about.”

Goldman’s analysis, which suggests businesses have held back from an all-at-once increase in prices, supports the argument that tariffs will ultimately be inflationary. The bank said tariff effects have boosted core PCE by 0.2% so far, with another 0.16% expected in July and an additional 0.5% over the rest of the year.

While American businesses have taken around 64% of the hit from tariffs so far, their share will fall to less than 10% as they pass on more of the costs onto consumers, according to the report.

The analysts added that the impact on US businesses has been mixed — while some have taken a larger share of the tariff hit, domestic producers shielded from competition have raised prices and benefited. Those opportunistic price rises also push up inflation.

Foreign exporters have absorbed an estimated 14% of the cost of tariffs through June, but their share may rise to 25%, Goldman said. The impact on foreign exporters can be gauged from a slight decline in import prices on tariffed goods, they said

US companies have so far taken the bulk of the hit from Trump’s tariffs but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote in a note. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote.

The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December, according to the Goldman analysts. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

The report adds weight to a widespread view among economists that Trump’s sweeping tariffs will fuel inflation at a time when Fed policy has become a hot topic not just for bond traders but even for the president himself. Trump has broken convention by publicly calling for the Federal Reserve to cut rates, suggesting Fed Chair Jerome Powell should resign and adding an ally — at least temporarily — to the monetary policy committee.

Bond traders are now looking ahead to Tuesday’s inflation data for clues on how fast the Fed can cut. Treasury 10-year yields rose around seven basis points last week, but fell during European trading hours Monday.

Traders are pricing in a more than 80% chance of a rate cut at the Fed’s next meeting in September, but the prospect of more easing in the months to come is clouded by the uncertain impact of tariffs on inflation.

Staggered Impact

Most economists consider tariffs to be inflationary, since logic suggests companies will pass the additional costs onto their customers. But the view isn’t unanimous — and the debate partly comes down to definitions.

“Inflation, certainly as it’s relevant to a central bank setting monetary policy, concerns an ongoing increase in the overall price level,” said Oren Cass, founder and chief economist at American Compass, in a recent episode of Bloomberg’s Trumponomics podcast. “If you choose a specific policy that by design makes a one-time change in the price of certain things, that is not inflation in a sense that you would want a central bank to worry about.”

Goldman’s analysis, which suggests businesses have held back from an all-at-once increase in prices, supports the argument that tariffs will ultimately be inflationary. The bank said tariff effects have boosted core PCE by 0.2% so far, with another 0.16% expected in July and an additional 0.5% over the rest of the year.

While American businesses have taken around 64% of the hit from tariffs so far, their share will fall to less than 10% as they pass on more of the costs onto consumers, according to the report.

The analysts added that the impact on US businesses has been mixed — while some have taken a larger share of the tariff hit, domestic producers shielded from competition have raised prices and benefited. Those opportunistic price rises also push up inflation.

Foreign exporters have absorbed an estimated 14% of the cost of tariffs through June, but their share may rise to 25%, Goldman said. The impact on foreign exporters can be gauged from a slight decline in import prices on tariffed goods, they said

You may also like

'Countering terrorism': US designates Balochistan Liberation Army terror outfit; decision after Asim Munir's visit

Cristiano Ronaldo engagement to Georgina Rodriguez confirmed with adorable message

Fox News halted as Donald Trump blasts 'bulls**t' in furious rant live on air

YSRCP seeks SEC's intervention for free, fair polling in Pulivendula

Tragic Homicide Investigation Unfolds in Garoh Village, Himachal Pradesh